-

Home

-

Products

- Solution

- WHY JUNPU

- Services

- Resources

- News

- Contact Us

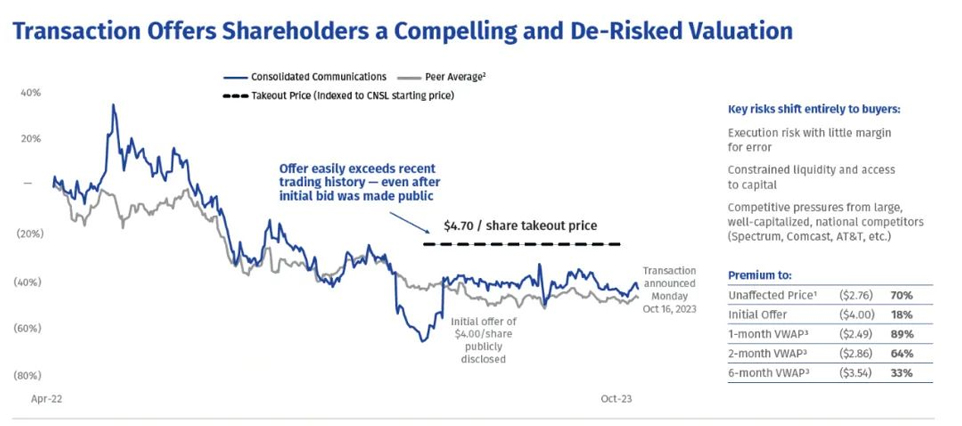

On Monday local time, Consolidated Communications, one of the top ten fiber optic suppliers in the United States, submitted a letter to shareholders requesting their vote in support of Searchlight Capital Partners and British Columbia Investment Management Corporation (BCI)'s acquisition proposal for the company. The shareholder letter written by the board of directors of the joint venture warns that if the merged company remains an independent company, it will not be able to provide funding for future fiber optic construction at the pace required to maintain competitiveness and sustained growth.

(Source of chart:Consolidated Communications)

The consolidated summary states that without the support of private equity, the company expects to complete fiber optic construction before 2029, three years later than the initial target. Specifically, Consolidated will be forced to significantly slow down its upgrade speed, reducing it to approximately 45000 to 75000 times per year. From 2021 to 2023, the average annual number of upgrades for the company exceeded 300000.

(Source of chart:Consolidated Communications)

The operator had previously stated plans to cover 70% of its footprint with fiber optic by mid-2026. The company stated in the letter that currently fiber optic coverage covers about 45% of its base. Consolidated wrote, "Considering the postponement of our plan, competitors will have more time to build fiber optics in certain markets before us, which has created a clear competitive disadvantage for us and will hinder future growth." It is reported that its competitors include well-known companies such as Frontier Communications, Lumen, Cable One, Shentel, ATN International, WideOpenWest, Altice USA, and Charter Communications.

(Source of chart:Consolidated Communications)

In April of this year, Searchlight and BCI first proposed to acquire the company. In October 2023, Consolidated announced that it would proceed with this $3.1 billion deal, which includes assuming the company's debt and announcing a final acquisition agreement to privatize its broadband business. Consolidated stated that the process of converting its traditional copper cable network to fiber optic network is "very capital intensive", with a total capital expenditure of approximately $1.5 billion since the operator's first transformation in 2021. The company also mentioned challenges from the "current operating environment", such as rising interest rates and inflation rates, declining voice and access revenue across the industry, "fierce competition" from "national scale providers" for broadband subscriptions, and "fiercely competitive and deflationary business and operator markets.". The shareholders of the merged company are scheduled to vote on the acquisition on January 31, 2024. The company has seen some investors boycotting this transaction. Wildcat Capital Management, which owns approximately 3 million Consolidated shares, wrote to its board of directors on November 3rd, stating that it believes the offer "seriously underestimates" Consolidated's equity. On the contrary, Wildcat stated that the consolidated enterprise is worth approximately $4 billion. In response to Wildcat's proposal, the Consolidated Board stated that investors' demand of $14 per share is unrealistic, while Wildcat's view overlooks recent realities such as operational risks, competitive intensity, and financing uncertainty faced by the company.

(Source of chart:Consolidated Communications)

Consolidated stated in its latest letter to shareholders that the merger board considers the above transaction (acquisition price of $4.7 per share in cash) to be fair and in the best interests of the company and its shareholders.

Call us on:

Call us on:  Email Us:

Email Us:  Wanhua Science and Technology Park, No. 528, Shunfeng Road, Donghu Street, Linping District, Hangzhou City, Zhejiang Province

Wanhua Science and Technology Park, No. 528, Shunfeng Road, Donghu Street, Linping District, Hangzhou City, Zhejiang Province