-

Home

-

Products

- Solution

- WHY JUNPU

- Services

- Resources

- News

- Contact Us

Adoption of 400Gbit/s routing technology is expected to drive growth in the service provider routing and switching market over the next five years, according to a new forecast from Dell'Oro Group.

The global service provider (SP) router and switch market revenue is expected to reach $76 billion by 2026, growing at a compound annual growth rate (CAGR) of 2%, Dell'Oro said. Both telcos and cloud service providers are predicted to benefit from the adoption of 400G routing technology in the form of network expansion and increased revenue.

Dell'Oro said that the adoption of 400G in wide area network (WAN) and data center interconnect (DCI) will play a major role in driving the growth of the routing/switching market.

Analysts expect the cloud SP segment to grow faster than the telecom SP segment over the next five years. Dell'Oro Group senior analyst Ivaylo Peev said that even with macroeconomic and geopolitical pressures, the company's July forecast for the router and switch market remains in line with its January forecast.

"Emerging economic uncertainty, racing-style inflation, China's COVID-19 dynamic zero policy, and the war in Ukraine are weighing on the market in 2022, putting pressure on both suppliers and customers," Peev said in a statement. "We have adjusted our forecasts to take into account these market challenges, but we have not changed our forecast baseline guidance as we believe the fundamentals of the SP router market will remain healthy over the forecast period. "

Analysts also expect that in the next five years, shipments of 400ZR modules and 400GE ports will gradually increase, and ZR optical modules will also bring new SP use cases. The ZR optical module supports data transmission up to 120 kilometers and is based on the 400ZR specification defined by the Optical Networking Forum (OIF).

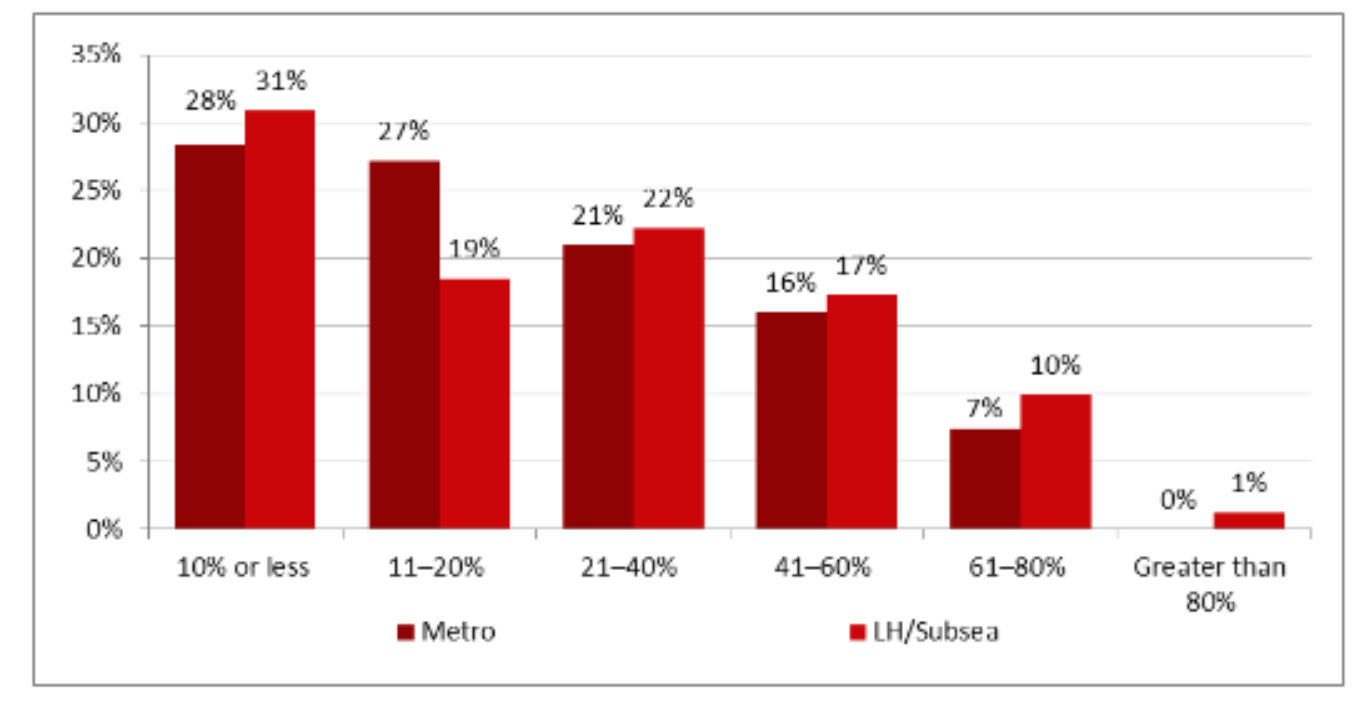

According to a recent Heavy Reading report, by 2025, the majority of respondents to the global operator survey "expect 400ZR/400G ZR+ penetration to exceed 25% in each major transmission segment, and between them It's fairly evenly distributed." These segments include DCI, metro aggregation, metro core and long-haul core. In addition, 400ZR and 400G ZR+ are expected to be most deployed in metro aggregation, metro core and long-haul applications.

More and more SPs have set their sights on deploying 800G capable systems in their networks. Continued 800G adoption looks promising over the next two years, as another 41% of surveyed CSPs (communication service providers) expect to deploy in that time frame. However, a third of CSPs (about 33%) expect to adopt coherent 800G in 2024 or later.

Between now and 2025, you expect the majority of embedded 800G coherent optics to be deployed in metro/long-haul/subsea network wavelengths.

In the early days, service providers mainly in the US market adopted 800G.

Perrin also said that one of the advantages of 800G is that "it can support not only the metro market, but also the long-haul and even the subsea market -- while operating at sub-600G data rates". However, most current use cases are focused on long-haul/subsea applications to achieve maximum data rates over longer distances.

Call us on:

Call us on:  Email Us:

Email Us:  Wanhua Science and Technology Park, No. 528, Shunfeng Road, Donghu Street, Linping District, Hangzhou City, Zhejiang Province

Wanhua Science and Technology Park, No. 528, Shunfeng Road, Donghu Street, Linping District, Hangzhou City, Zhejiang Province